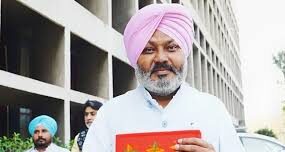

Passing on GST rate cut benefits to Punjab consumers is a big challenge, says Harpal Cheema.

The Punjab government is bracing for challenges arising from the recent cut in the goods and services tax (GST) rates, particularly passing on the benefits to consumers and managing the revenue loss to the state.

Finance and taxation minister Harpal Singh Cheema said the biggest challenge of the GST overhaul would be to make sure that the benefits of the reduction in tax rates actually reach consumers. He said that while automakers, white goods manufacturers and other large companies have announced rate revisions and are selling at reduced rates, the role of retailers in their dealings with customers will be crucial in ensuring that price benefits on mass consumption products reach the lower middle class and other sections of society.

Incentive-based scheme to strengthen tax compliance

According to Cheema, specialised teams will be sent in to keep an eye on price reductions under GST 2.0 and take appropriate measures if the state’s consumers aren’t benefiting. We’ll be monitoring pricing adjustments, and customer grievances regarding costs will be immediately resolved. “The state government is ready to guarantee compliance, and the ‘Bil Liao, Inam Pao’ (bring a bill, get a reward) scheme will also prove useful in verifying price cuts have been implemented,” he told HT. In order to improve tax compliance and encourage customers to get bills from dealers and retailers for their purchases, the incentive-based programme was introduced in September 2023. On September 2, the GST Council, led by Union Finance Minister Nirmala Sitharaman, adopted comprehensive revisions that rationalised rates and simplified compliance by creating a two-slab structure of 18% and 5% for the majority of products and services. On September 22, the first day of “Navratri”, the decision to cut prices on 375 items went into effect. Within the first 48 hours, auto and e-commerce sales hit all-time highs. In order to determine if dealers and retailers are transferring the benefits, the Central Board of Indirect Taxes and Customs (CBIC) has instructed all of its field offices to gather data on product prices from them.

loss due to GST rate cuts.

The effect of the reductions in the goods and services tax rates on the government’s revenue is another difficulty facing Punjab. According to Cheema, the most recent changes to the consumption tax rates are expected to result in a 20% drop in the state’s GST collection of nearly ₹6,000 crore. Because we rely so significantly on the GST, this decline will have a significant effect on the state’s own tax income. When the goods and services tax was implemented in 2017, our revenues were negatively impacted, and this time they are,” he stated.

The debt-ridden state’s own tax revenue has been primarily derived from the GST. The state estimated that GST would generate ₹27,650 crore, or roughly 44%, of the ₹63,250 crore in own tax income that was expected in the 2025–26 budget forecasts. According to the minister, he requested at the GST Council meeting a five-year extension of the compensating cess, with 2024–2025 serving as the base year, or some other option to make up for Punjab’s revenue loss from the overhaul of the goods and services tax until fiscal stability is attained. But the request was turned down.